The Advantage

A NEWSLETTER FOR OUR MEMBERS | ISSUE 2 | 2024

Posted 06/27/24

Direct-to-Consumer Prescription Drug Advertising

The Pros and Cons

Drug companies advertise directly to consumers through TV, magazines, and social media. These ads have increased dramatically in recent years and have advantages and drawbacks.

Pros

Some benefits include providing education on conditions and treatments that you may not know about and could increase your involvement in your health care. They can also reduce stigma around certain health conditions and encourage you to have conversations with your provider.

Cons

Some drawbacks include little regulation on what manufacturers can say, providing limited information on potential side effects and risks. Ads may lead people to ask for medications they don’t need.

FDA Regulation

The Food and Drug Administration (FDA) regulates ads for prescription drugs, but don’t always review ads before they run. Ads are required to list at least one approved use for a drug, the generic name, and all risks of the drug. However, ads are NOT required to tell the medication cost, if there is a generic version, if there are similar drugs with fewer or different risks, and more. You can find more information on the FDA website at www.FDA.gov/drugs.

Consumer Advice

If you see an ad for a medication that you think you may benefit from, we encourage you to do more research, including:

- Visit the manufacturer’s website to see all the risks and benefits.

- Check for interactions with your other medications, vitamins, and supplements.

- Check if there are any added risks if you have any other medical conditions.

Effectiveness can vary from person to person. Your provider may be aware of other medications (some less costly), and non-medication measures which may work better for you.

Exercise Is Good Medicine for Your Body and Mind

Ask your doctor what activity level is right for you!

We all know that getting regular exercise is a great way to take care of our physical health. Benefits include strengthened muscles and bones, improved balance, lowered cardiovascular health risks, and more.

But did you know that exercise may also help promote and preserve your emotional and mental health? Studies show that adding physical activity to your day may help boost your mood and reduce symptoms of depression and anxiety.

If you’re ready to add more physical activity to your life, here are some tips to get you started.

Talk to your doctor before you start. If you have any health problems, or if you haven’t exercised in several years, ask your doctor about:

-

What activities are safe for you

-

How hard you should exercise

-

What goals you should be aiming for

Start slowly. Walking is a great activity that most people can start with. Increase your activity day by day.

Make it a habit. Make physical activity a daily routine. If you are able, make a habit of using stairs and walking to do errands.

Have fun. Choose an activity you enjoy and mix it up so you don’t get bored.

Do it together. Find an activity partner if that will help keep you on track. Joining an exercise group or health club can provide social connections that can improve mental health.

Use your Wellness Wallet benefit! Get reimbursed for gear, lessons, and services that support your active lifestyle! Visit our Wellness Wallet page to learn more!

Warmer Weather?

Think “Wellness Wallet!”

Now is a great time to use your Wellness Wallet for summertime activities. Get reimbursed up to your annual amount for gear, lessons, and club fees.

- Golf

- Pickleball

- Bikes

- Tennis

- Softball

- Bocce Ball

- Frisbee

- Shuffleboard

- Hiking

- Kayak/Canoe

- Athletic Sneakers

- And more!

Wellness Wallet

Visit our Wellness Wallet page to learn about using this valuable benefit:

-

Find a list of items/services eligible for reimbursement.

-

Find instructions and a link to submit an online reimbursement request.

-

Download 2024 Reimbursement Request Form to mail in.

-

Find answers to common Wellness Wallet questions.

Member Services is here to help at 1-866-544-7504 (TTY: 711) Monday through Friday, 8 am-8 pm.

Tips to avoid a delay or denial of your Wellness Wallet reimbursement.

- Itemized receipts and proof of payment documents (COPIES ONLY) must be enclosed with mailed requests or uploaded with online requests.

- They must show:

- WHAT was purchased

- HOW MUCH it cost

- HOW YOU PAID for it

- the DATE it was purchased

For mailed-in requests:

- Use the 2024 form ONLY and complete all sections.

- Mail form and copy of receipt/proof of payment to:

Martin’s Point

Generations Advantage Claims Department

P.O. Box 3003

Fargo, ND 58108

Staying on Your Feet

Your extra plan benefits may help!

Feeling unsteady on your feet? Balance changes can become more common with aging. Some factors affecting balance are medications, inner ear problems, poor eyesight, and medical conditions such as stroke, Parkinson’s, or neuropathy from diabetes.

If you are having problems with balance or dizziness, make sure to speak with your doctor so they can help you find the root cause of the problem and discuss what treatment options are available.

Your extra plan benefits may help improve your balance:

Wellness Wallet: Exercises for balance and lower-body and core strength can help steadiness. Your Wellness Wallet reimburses up to your plan’s annual amount for fitness classes (includes online) and mobility-support and strength-training equipment. Learn more about the Wellness Wallet benefits.

Over-The-Counter (OTC) Items: Bathroom safety equipment and devices to help you safely sit, stand, and walk can provide extra stability, indoors and out. Use your quarterly amount to purchase over-the-counter items that include: Raised toilet seat, shower chair, rubber bathmat, travel walker, and canes. Discover more about OTC benefit.

Vision/Eyewear: Studies show that vision takes on a more important role in balance in older adults. Your plan covers an in-network annual routine vision exam with a $0 copay plus an annual eyewear allowance. Explore the vision and eyewear benefits available to you.

Have you experienced a fall or suffered a hip fracture? If so, you may qualify for a $200 reimbursement on some bathroom safety equipment and $50 reimbursement on some fall-prevention classes. Please call Member Services at 1-866-544-7504 (TTY: 711) to see if you are eligible for this benefit.

Diabetes and Chronic Kidney Disease

Regular monitoring is key to kidney health.

Did you know? One third of all adults with diabetes have chronic kidney disease. Unfortunately, reversing existing kidney damage is rare and people with later-stage kidney disease may require a kidney transplant or frequent filtering of their blood (dialysis) in order to live.

The good news is that regular testing can help detect and monitor the progress of kidney disease, so you can take steps with your provider to maintain kidney health.

If you have diabetes, these tips can support your kidney health:

-

Get yearly kidney blood tests (eGFR) and urine tests (uACR) to measure protein in your urine.

-

Maintain or work toward your blood sugar goals. Have an A1c test twice yearly which reflects your average blood sugar level. Controlling your blood sugar levels supports kidney health and helps avoid complications like cardiac events, strokes, vision loss, or nerve pain.

-

Maintain or work toward your blood pressure goals.

-

Eat low-salt foods.

-

Stay physically active.

-

Take medications as prescribed.

Speak with your doctor about:

-

Your most recent kidney test results and what they mean

-

Your target goals for blood pressure, A1c, and cholesterol

-

What steps to take and when to follow up if not hitting your goals

-

Your medications—ask if any could harm your kidneys

-

Any signs and symptoms to watch for that could show a kidney problem

Finding and managing kidney disease early is key. If you have diabetes and your doctor hasn’t mentioned your kidney health in the past year, we encourage you to start the discussion. Visit our Diabetes Wellness Guide to see other resources and tips for managing diabetes.

Follow Up with Your Doctor after an ER Visit or Admission!

Research shows that a timely follow-up appointment with your health care provider after a visit to the Emergency Room or hospital stay is the best way to prevent unnecessary complications and hospital readmissions. Follow-up care provided in your primary care provider’s or a specialist’s office is also much less costly than another ER visit or admission that could be prevented.

Timing is important! Earlier follow-up care has been shown to have better outcomes. If you have multiple chronic conditions, it is best to be seen within a week of your ER visit or hospitalization. The maximum wait for a follow-up visit by phone, telehealth, or in-person would be 30 days after discharge.

We urge you to schedule a follow-up appointment with your provider if the hospital does not arrange one for you.

How do follow-up visits support better health outcomes?

During your follow-up visit, your provider will ensure you understand your discharge instructions and any medication or treatment plan changes. They will make sure the new plan doesn’t conflict with your previous plan and that it is working and symptoms are improving. They will also discuss any new symptoms or side effects you may have from new medications. They can help schedule any needed referrals and tests/procedures and provide education about any new diagnoses or medications. Your doctor will decide if your follow-up care may be done through a telehealth or phone visit.

Have you recently been discharged home from the hospital and feel you could benefit from a care manager?

Martin’s Point has a team of nurse and social work care managers who can work with you to review the discharge plan, provide education and community resources, review your medication list with you, help coordinate services or get needed medical equipment, and assist with coordinating follow-up appointments with providers.

Feel free to call our Care Management team at 1-877-659-2403. They are happy to help!

Self-Advocacy with Your Doctor

Speak up to get the most out of your health care.

Self-advocacy means speaking up to share your concerns and express what you want to get out of your health care experience. Medical decisions impact you the most, so it’s important to be an active member of your health care team. Below are tips on how to advocate for yourself when working with your doctor’s office.

Be Proactive

If you haven’t already, schedule your Annual Wellness Visit. This conversation with your provider reviews your medical history and current health status, developing a prevention plan to meet your needs. An Annual Wellness Visit differs from a routine, preventive physical exam. Both are covered in-network with a $0 copay. Ask your provider if they can schedule both services in one “comprehensive visit.” Download our handy Preventive Care Checklist to see screenings, tests, and immunizations you may be due for.

Bring Support

With a lot of information being shared at medical appointments, it can be easy to miss or misinterpret things. Bring a friend or family member to take notes to ensure you get the full and correct message.

Come Prepared

Bring your most up-to-date medication list and any logs of home blood pressure readings, blood sugar numbers, or weight you’ve been asked to record. Write down questions or health concerns you want to discuss with your provider.

Know the Follow-up Plan

Don’t be afraid to ask clarifying questions and take notes. Here are some key points to cover:

-

Medications: Make sure you understand any changes. For a new medication (especially for controlling blood pressure or blood sugars), ask how and when you should follow up with the provider to ensure it’s working.

-

Labs/Tests: Ask how and when you should expect results. Results are often posted immediately on a patient portal.

-

Referrals: If a test or specialist referral is made, ask when is a reasonable time to expect a call and what steps you should take after that time.

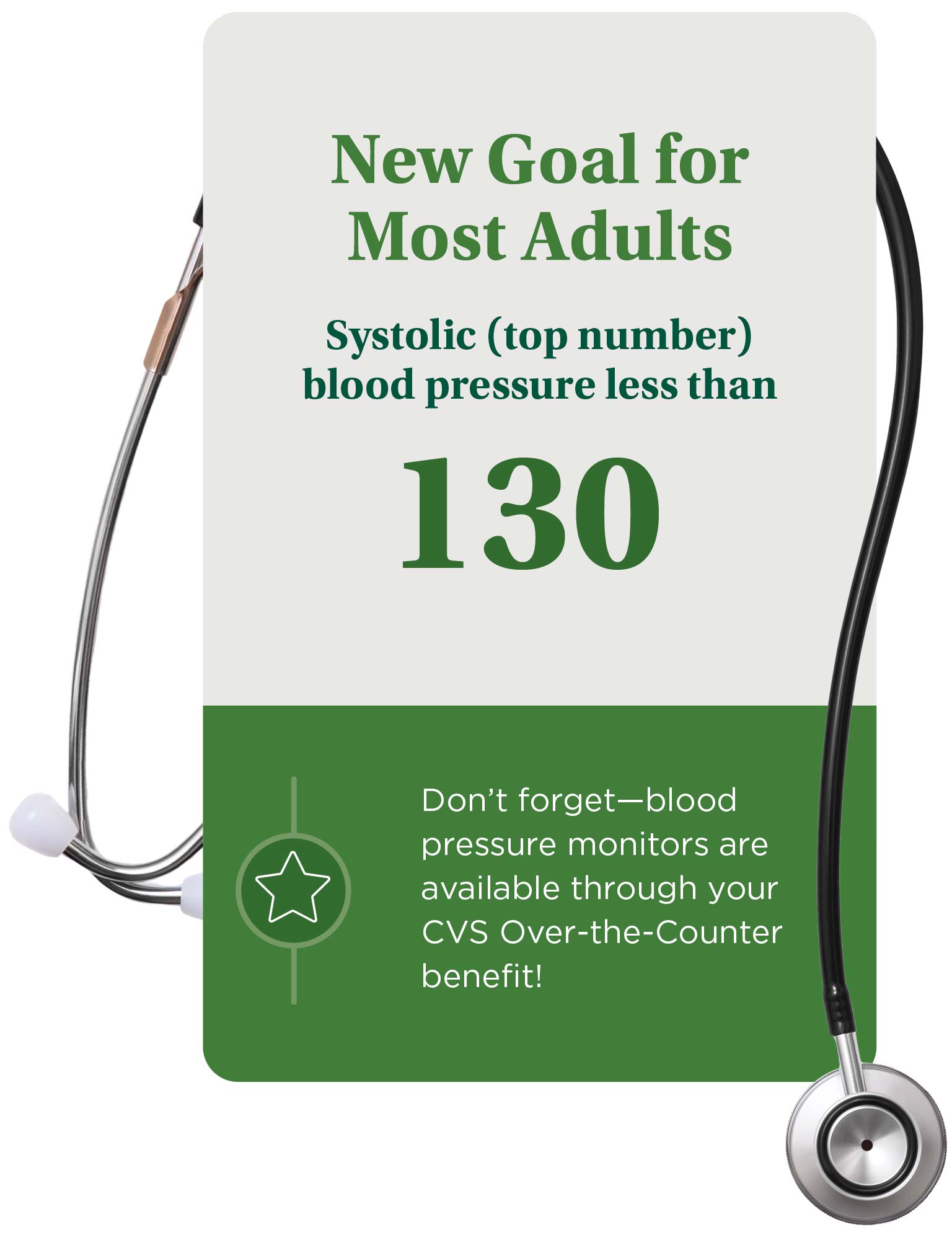

Managing Your Blood Pressure for Your Best Health

The blood pressure goal for most adults has changed.

High blood pressure (hypertension) is called a “silent killer” because most people with this condition feel no symptoms but can be at high risk for heart attacks, strokes, and kidney disease.

Recent studies have led to a change in the goal for most adults—to have a systolic pressure (top number) lower than 130. A National Institutes of Health clinical trial found that a systolic blood pressure near 120 in people over age 50 reduced deaths by nearly a quarter compared to those with a goal lower than 140. It also showed a nearly one-third reduction in the combined rate of having a heart attack, heart failure, stroke, or death from cardiovascular disease.

There are lots of things you can do to manage high blood pressure—like staying active, cutting salt, and reducing stress, and, if needed, taking medications as directed. Blood pressure checks are the best way to monitor your health and hypertension management.

Most importantly, review these blood pressure questions regularly with your doctor:

- What’s my blood pressure goal and how often should I check it?

- How can I lower my blood pressure?

- What symptoms or blood pressure range should prompt a call to my provider?

- When should I schedule my next visit to follow up on my high blood pressure?

To learn more about managing high blood pressure and how to perform an accurate blood pressure check, please visit

Heart Health page.

Adults Need Vaccines, Too!

Learn how your Generations Advantage plan covers each below.

Adult vaccines protect against diseases that can cause serious health conditions and even death.

Shingles: Painful rash that can cause nerve pain that can last years.

Tetanus: A deadly disease (historically known as lock jaw) causing convulsions and muscle stiffness that can impact breathing and result in bone fractures.

Pneumococcal: Can cause pneumonia, meningitis, and even death.

Influenza: Flu can cause pneumonia, bronchitis, sinus infections, and death.

TDAP: Tetanus, diphtheria, and pertussis.

-

Diphtheria: Often affects the throat, making it difficult to swallow or breathe. Complications can involve the heart or nervous system.

-

Pertussis: (also known as whooping cough) causes rapid coughing with difficulty breathing. Pneumonia is a common complication.

Common Vaccines Covered under Medicare Part B or Medicare Part D

| Vaccine | Your Cost at Doctor’s Office* | Your Cost at a Pharmacy |

|---|---|---|

|

Flu (influenza)

Medicare Part B Quadrivalent, Trivalent, Intradermal, High Dose |

You pay $0 for the vaccine. | |

|

Pneumonia

Medicare Part B Pneumovax®, Prevnar 13®, Prevnar 20® |

You pay $0 for the vaccine. | You pay $0. You must bring a prescription to the pharmacy. |

|

Shingles

Medicare Part D Shingrix® |

You may have to pay full cost and submit to the plan for 100% reimbursement for the vaccine. Requires two shots and two payments/reimbursements. | You pay $0. You must bring a prescription to the pharmacy. |

|

TDAP

Medicare Part D Adacel®, Boostrix® |

You may have to pay full cost and submit to the plan for 100% reimbursement for the vaccine. | You pay $0. You must bring a prescription to the pharmacy. |

|

Tetanus**

Medicare Part D (Preventive—NOT treatment of wound) |

You may have to pay full cost and submit to the plan for 100% reimbursement for the vaccine. Prior authorization is required for reimbursement. | You pay $0. You must bring a prescription to the pharmacy. Prior authorization is required. |

|

Tetanus**

Medicare Part B (Treatment of wound) |

You pay 20% of the cost of the vaccine. | Not available at a pharmacy. |

*At doctor’s office: You may also have an office visit copay.

**Before any tetanus vaccine, your doctor/pharmacist must call CVS Caremark for authorization.

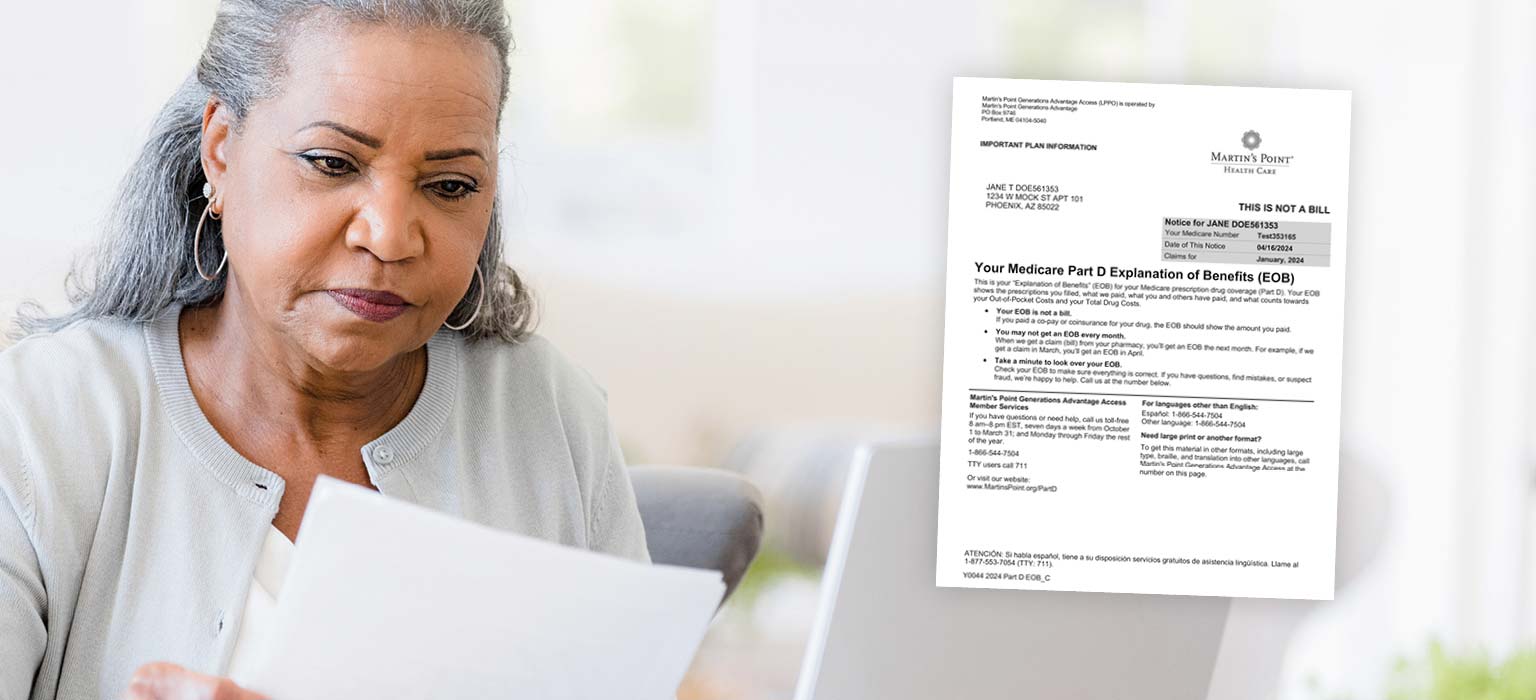

Understanding Your Medication Explanation of Benefits (EOBs)

Sign up for convenient, online EOBs!

If your Martin’s Point Generations Advantage plan includes Part D Prescription Drug coverage, you can choose to receive your monthly medication EOBs online or by mail. Paperless medication EOBs provide the same information in the same format as the printed one, and they’re faster and more convenient.

To sign up for online EOBs, visit Caremark.com/paperless. There you can register through their portal to access a secure, online prescription management center available anytime. You can also register to get information about and manage your prescriptions and monitor out-of-pocket spending.

Your medication EOB shows what prescriptions you filled in the previous month. If a pharmacy canceled a prescription you didn’t pick up, the cancellation may appear on the following month’s EOB.

Your MONTHLY prescriptions for covered Part D drugs: JANUARY 2024

Totals for the month of January 2024

• Your Out-of-Pocket Costs amount is $658.04

• Your Total Drug Costs amount is $780.35

Your YEARLY spending totals for covered Part D drugs

Totals for the year-to-date

• Your Out-of-Pocket Costs amount is $733.04 (includes what You Paid plus Other Payments)

• Your Total Drug Costs amount is $4,496.88

| You Paid | Plan Paid | Other Payments | Total Drug Costs | |

|---|---|---|---|---|

| Monthly totals: January 2024 | $184.22 | $122.31 | $473.82 | $780.35 |

| Year-to-date totals: January – January 2024 | $259.22 | $3,763.84 | $473.82 | $4,496.88 |

Your current drug payment stage

| Year-to-date totals: January – January 2024 | Stage 1: Yearly Deductible | Stage 2: Initial Coverage | You're in Stage 3: Coverage Gap | Stage 4: Catastrophic Coverage |

|---|---|---|---|---|

| Out-of-Pocket Costs | lasts until Out-of-Pocket Costs reach $545.00 |

lasts until Total Drug Costs reach $5,030.00 | $733.04 | starts when Out-of-Pocket Costs reach $8,000.00 |

| Total Drug Costs | $4,496.88 |

Medication Therapy Management

Tips to prepare for speaking with the pharmacist

Medication Therapy Management (MTM) is a free benefit for members who qualify based on their health conditions, medications, and prescription spending. The benefit includes a “Comprehensive Medication Review (CMR)”—a consult with a pharmacist to review all your prescription and over-the-counter medications and supplements. The pharmacist will help you understand your medications, how best to take them, and if there are ways to lower your medication costs.

If you qualify, your local pharmacy or a contracted center may call to schedule an in-person or phone appointment. Yearly CMRs are recommended if you continue to qualify. Here are some helpful tips to prepare for your CMR appointment:

- Write down the scheduled time and place for your appointment.

- Write down your pharmacy-related questions to ask during your scheduling phone call so your pharmacist can prep answers before your CMR appointment.

- Be ready to provide the name, strength, and directions for prescriptions, over-the-counter products, and supplements.

- Let the pharmacist know if you need any refills or help getting a prior authorization.

- Try to schedule pharmacy-covered vaccines at the same time as your in-person CMR appointment or at an upcoming prescription refill.

After your CMR appointment, your updated medication list and review of the meeting will be mailed to you and your primary care provider. The pharmacist may also contact your provider to discuss any time-sensitive topics.

Do you qualify for the Medication Therapy Management benefit?

We will automatically enroll you in the program at no cost if you have coverage limitation(s) for medication(s) with a high risk for dependence and/or abuse OR ALL THREE following conditions apply:

- You take eight or more Medicare Part D-covered maintenance drugs, AND

- You have three or more of these long-term health conditions:

- Asthma, chronic obstructive pulmonary disease (COPD), diabetes, depression, osteoporosis, chronic heart failure (CHF), cardiovascular disorders (such as high blood pressure, high cholesterol, or coronary artery disease) AND

- You are likely to reach $5,030 in yearly prescription drug costs paid by you and the plan.

Your participation is voluntary and does not affect your coverage.

In-Home Visits—Where We Come to You!

Staying on top of your health is about to get a lot easier. Martin’s Point Generation Advantage is partnering with Matrix Medical Network to bring your next checkup right to your home—at no cost to you.

In addition to your annual preventive exam with your primary care provider, an in-home visit offers complementary support to your regular medical care by

helping you stay connected to important health services. Even if your health is in great shape, an in-home visit can have a real impact on your overall well-being.

Learn more about these free visits by going to www.matrixforme.com or by calling Matrix Medical Network at 1-855-430-9395 (TTY: 711) Monday–Friday, 8 am–8 pm or Saturday, 8 am–5 pm.

Quick Notes

Behavioral Health Care Management Program

A Martin’s Point care manager can help address ongoing behavioral health needs. To speak with a Martin’s Point behavioral health care manager about our free care management program, call 1-877-659-2403.

Learn more about ways to support the mental health of adults and children on our Mental Health page to learn more.

Staying in Touch

Please keep your contact information up to date. We want to make sure you get plan-related information when you need it. Let us know if you have a change in your contact information or your primary care provider by calling Member Services at 1-866-544-7504 (TTY: 711). You can also update your primary care information on your member portal!

Martin’s Point in the Community

Did you know that Martin’s Point partners with other local, nonprofit organizations to foster healthier communities? To learn about just a few of our partnerships—including Grandparents Day with the Portland Sea Dogs, Maine Senior Games, and I’m Your Neighbor Books—please check out our 2023 Community Impact page.

To Contact Your Plan:

Material presented in this newsletter is not intended to replace your health care provider’s medical advice. Martin’s Point Generations Advantage is a health plan with a Medicare contract offering HMO, HMO-POS, and local PPO products. Enrollment in a Martin’s Point Generations Advantage plan depends on contract renewal. Martin’s Point Health Care complies with applicable federal civil rights laws and does not discriminate on the basis of race, color, national origin, age, disability, or sex.